How much a provider can charge for travel under the NDIS depends on the type of travel.

The NDIS defines transport costs in 2 ways: General Transport Supports and Activity-Based Transport

1. NDIS General Transport Supports

-

This funding is for participants who cannot use public transport due to their disability. Providers can charge them to transport them to an activity. For example: travelling to and from work or appointments.

- This funding cannot be used by a participant to transport a carer or to pay someone in their family to drive them around.

- The amount of funding a participant receives will depend on their individual circumstances.

2. NDIS Activity Based Transport

Support worker accompanying participants for community access (CORE)

- A participant may need a worker to accompany them on a community outing and/or transport them from their home to the community (and back). The time the support worker spends transporting them can be claimed at their agreed hourly rate.

- For example: A support worker drives a participant to a community activity which is 30 min away. The time spent at the activity is 2 hours. They drive home again afterwards, The total amount used from the NDIS plan is 3 hours @ support worker hourly rate.

- This amount is claimed from the relevant Assistance with social and community participation support item in the participant’s CORE budget. Different rates if more than one participant travelling.

Additional transport cost when accompanying participants for Community Access (CORE)

- If a support worker incurs extra 'non labour' costs, they can now bill a participant for these as part of the community participation support funding in a participants plan (from their CORE).

- Extra non-labour costs may be:

- the cost of a ticket for public transport

- road tolls

- parking fees

- the running costs of the vehicle

- IMPORTANT: A participant has to agree to pay these amounts first, so providers will need to discuss it upfront - your service agreement should cover this.

- This amount is claimed in the portal under Assistance with social and community participation > Activity Based Transport in the CORE section of their plan.

Additional transport cost for Capacity Building Supports (CAPACITY BUILDING)

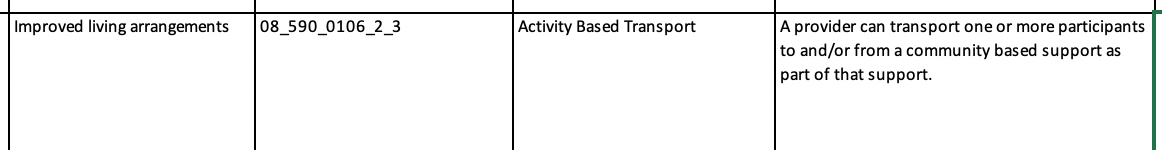

- A participant can also pay providers of the following capacity building line items for Activity Based Transport when they are delivering their supports

- Finding and keeping a job

- Improved learning

- Improved living arrangements

- Increased social and community participation (cost of the activity)

- Improved relationships

- Example: include supermarket trips with a support worker, going to the footy with a support worker or going for a coffee with a support worker.

- This amount can be claimed from the relevant CAPACITY BUILDING support item. For example:

How much can an NDIS Provider claim for the running costs of a vehicle?

The amount that a participant can pay a provider is not price-controlled, but the NDIS has provided a guide as to what is considered reasonable:

- up to $0.85 a kilometre for a vehicle that is not modified for accessibility

- up to $2.40 a kilometre for a vehicle that is modified for accessibility or a bus

- other forms of transport or associated costs up to the full amount, such as road tolls, parking, public transport fares

For example: A support worker drives a participant to a community activity which:

- is 20km away

- takes them 30 min to drive each away

- the support worker uses their own car that is not modified

- there is a toll cost of $5

- there is a parking cost of $15

- the time spent at the activity is 2 hours

The total amount that can be claimed from their NDIS plan is:

3 hours of support + $5 Toll + $15 parking + $0.85 x 40km running costs

When can a Provider charge for travel?

Providers can only claim travel costs if ALL of the following conditions are met:

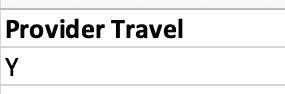

- the NDIS Support Catalogue shows Travel is allowed to be claimed. There should be a Y in the 'Provider Travel' column in the NDIS Support Catalogue:

- the travel charge complies with pricing guides from the NDIS (I.e cannot charge more than allowed)

- the travel is necessary in order to deliver a specific disability support item to that participant

- the support is delivered face-to-face to the participant

- the provider explains the travel charge and why it is a good use of the participant's funds

- the provider has the participant's agreement that travel costs can be claimed and the amount that can be claimed

- the provider is required to pay the worker delivering the support for the time they spent travelling

OR the provider is a sole trader and is travelling from their usual place of work to or from the participant, or between participants.

How much can a provider charge for Travel?

The maximum amount of travel time a provider can claim for the time spent travelling to each participant (for each eligible worker) is:

- 30 minutes in MMM1-3 areas

- 60 minutes in MMM4-5 areas.

How much can Therapist/Capacity Building Provider Charge?

See our resource titled How much can me NDIS therapist charge me for travel

What transport costs CAN'T be claimed from an NDIS Plan?

- Transporting participants to doctor's appointments

- Transporting participants to visit friends

- Providers of SLES supports cannot be paid for Activity Based Transport related to the delivery of the supports.

NDIS THERAPY FINDER - FREE SERVICE

LET US FIND YOU A SKILLED SUPPORT WORKER